)

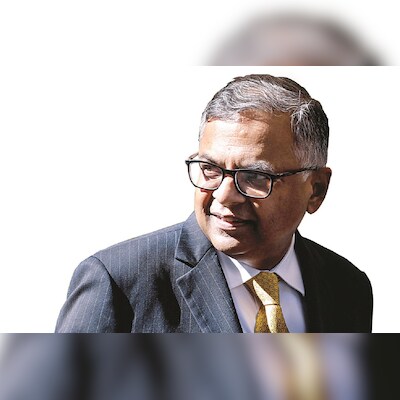

N Chandrasekaran, Chairman, Tata Motors

The proposed demerger of passenger vehicle (PV) and commercial vehicle (CV) businesses would help secure synergy among electric vehicles (EVs), autonomous vehicles and vehicle software, Tata Motors chairman N Chandrasekaran told shareholders at the company’s 79th annual general meeting (AGM) on Monday. The company would continue to focus on “financial strength” and enhancing customer experience through differentiated strategies, he said.

Chandrasekaran told shareholders in the virtual AGM that the demerger would enable sharper execution of their well-differentiated strategies and further empower each business to pursue it purposefully with greater agility and accountability.

The Board has proposed the demerger of the company into two separate listed firms housing the CV business and its related investments in one entity and the PV business, including EV, JLR and related investments, in another entity.

“This will lead each company to deliver a superior experience for customers, better growth prospects for employees and enhanced value for shareholders,” Chandrasekaran said.

Tata Motors will continue to focus on improving its “financial strength” and enhancing customer experience. The company will adopt more “differentiated” strategies for further growth in the market, he said.

Chandrasekaran added, “While we are seeing growth and stability in India, the global geopolitical scenario continues to remain troubled with continuing military conflicts. The coordinated actions by the central banks of several countries have helped moderate inflation, albeit absolute price levels continue to remain high. The economic scenario is expected to stabilize with global growth estimated to be around 3 per cent during the next couple of years.”

On a consolidated basis, the company delivered a strong performance — total vehicle sales increased 7.4 per cent year-on-year (Y-o-Y) to over 1.38 mn units. Revenues stood at Rs 4.37 trillion, EBITDA at Rs 62,800 crore and net profit at Rs 31,800 crore (up by Rs 29,100 crore over the previous year). The India automotive business is now debt-free, and the company is on track to make JLR debt-free in FY25.

Tata Motors PV and EV businesses sold 570,000 units, up 6 per cent, in FY24. The new production facility at Sanand was operationalised within a year of acquiring it from Ford India. CV business is focused on growing its non-vehicular businesses (spares and services) and smart mobility solutions for cities. JLR recorded the highest-ever annual revenues of 29 bn pounds and record free cash flows of 2.3 bn pounds in FY24.

The Tata Motors chairman said going forward, the PV business will continue to invest in products, platforms, electrical & electronic architectures, and vehicle software to remain competitive. The EV business will focus on deepening penetration through multiple product launches, concentrate on market development, charging network enhancements and continuing to introduce aspirational product features. Apart from vehicular business, the CV arm will focus on vehicle park-linked businesses like spares and digital & smart mobility solutions, which will help reduce the volatility of vehicle sales business.

“JLR will continue to double down on its journey to become a premium luxury OEM (original equipment manufacturer), focus on enhanced customer love and continue to invest in products and technologies. There is an exciting range of products lined up to be launched over the next three years that needs to be delivered successfully,” the chairman said.

The first electric Range Rover will be launched later this year, and there are further EVs lined up in the coming years, including the all-electric Jaguar.

During FY24, Tata Motors undertook several strategic corporate actions to simplify and strengthen its capital structure. These included successfully completing the delisting of its American Depositary Shares from the New York Stock Exchange; diluting a part of its stake in Tata Technologies Ltd through a successful IPO, and securing shareholder approval for a capital reduction scheme for the DVR (differential voting rights) shares. “More recently, we have announced the merger of Tata Motors Finance with Tata Capital Ltd,” he said.

First Published: Jun 24 2024 | 7:07 PM IST

#Demerger #secure #synergies #EVs #autonomous #vehicles #TaMo #chief #Company #News

+ There are no comments

Add yours